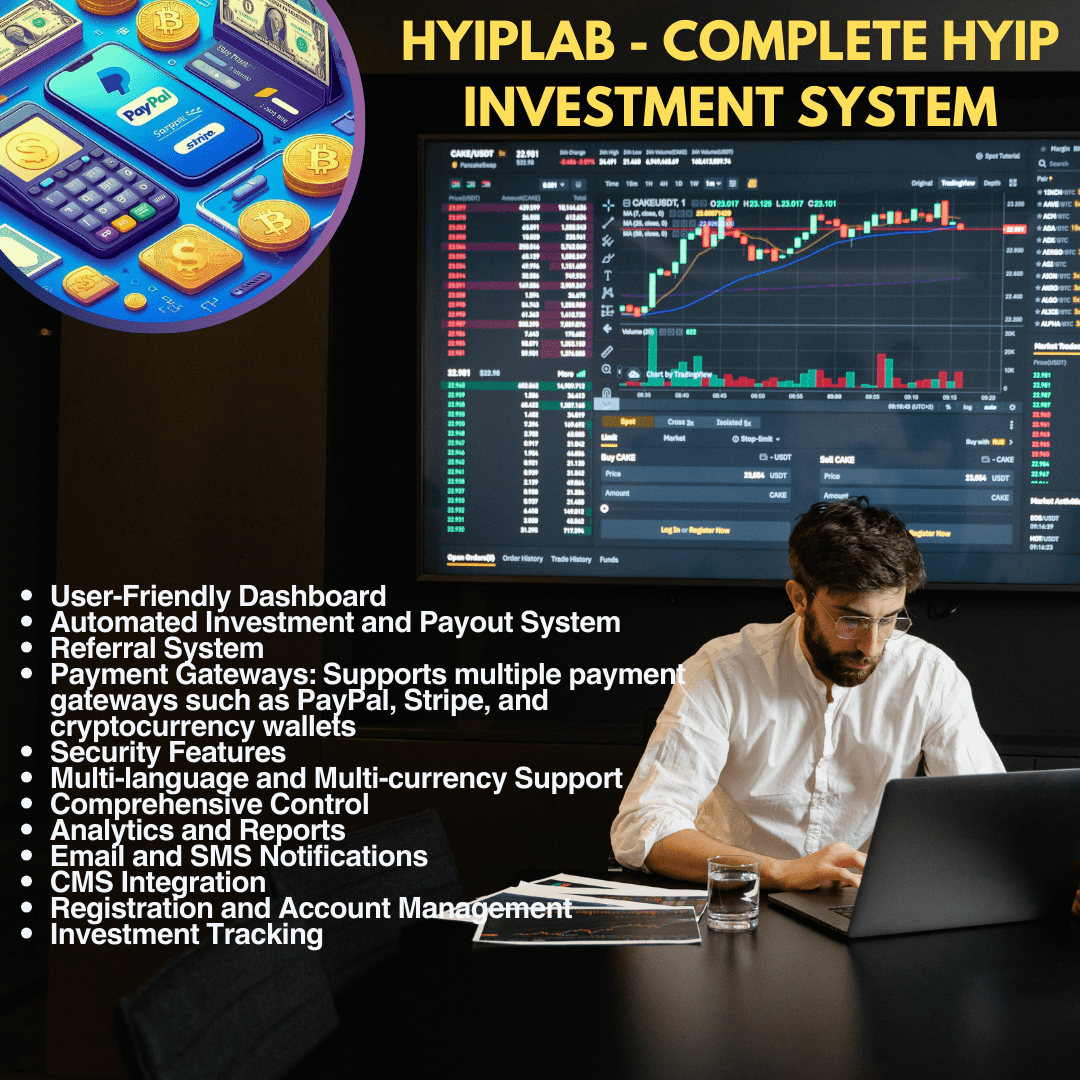

HYIPLAB – The Complete HYIP Investment System is a comprehensive platform designed to manage high-interest investment programs (HYIPs). This is a type of system commonly used to manage investments where users deposit money and receive high interest rates in a short period of time, which is very popular in HYIPs. Here is a detailed description of the HYIPLAB software:

1. Key Features:

– User-friendly Dashboard: Both administrators and investors have access to a dashboard with real-time updates on investments, earnings, and other relevant metrics.

– Investment Plans: Allows the creation of multiple investment plans with different durations, interest rates, and terms. Administrators can customize these plans according to their specific needs.

– Automated Investment and Payment System: Automatically process user deposits, allocate investments, and pay out profits according to specified terms.

– Referral System: Users can refer others to join the program and earn commissions. The referral system can be decentralized, providing commissions on multiple referral levels.

– Payment Gateway: Supports multiple payment gateways such as PayPal, Stripe, and cryptocurrency wallets (e.g. Bitcoin, Ethereum), making it flexible in payment processing.

– Security Features: Includes two-factor authentication (MFA), data encryption, and IP whitelisting to protect user data as well as the overall system.

– Multi-language and multi-currency support: The platform supports multiple languages and currencies, allowing for global use.

– KYC/AML compliance: Integrates KYC (Know Your Customer) and AML (Anti-Money Laundering) processes to help meet regulatory requirements.

2. Admin Dashboard:

– Full Control: Admins have full control over user accounts, investment plans, transactions, and overall platform configuration.

– Analytics and reporting: Provides detailed analytics and reporting tools to monitor the performance of investment plans, user activity, and the financial health of the system.

– Email and SMS notifications: Automatic notifications can be set up for various activities such as successful deposits, payments, account changes, etc.

– CMS integration: Content Management System (CMS) integration allows administrators to manage website content such as news, updates, FAQs, and more.

3. User Experience:

– Account registration and management: Easy registration process with the ability to manage personal details, view portfolio, trading history, and referral earnings.

– Deposit and withdrawal: Users can deposit funds into their accounts and withdraw earnings through multiple methods supported by the platform.

– Investment Tracking: Users can track their investments in real-time, including details on accrued interest, maturity dates, and more.

4. Technology used:

– Programming language: Mainly built with PHP and JavaScript.

– Database: Use MySQL to store data.

– Framework: Use Laravel, a popular PHP framework, for backend development.

– Frontend: Responsive and mobile-friendly design, often using Bootstrap or similar frameworks.

5. Customization and Scalability:

– Customization: The platform can be tailored to meet specific business needs, from modifying the investment plan structure to branding the user interface.

– Scalability: Designed to handle growing user numbers, multiple concurrent transactions, and increasingly large data loads without sacrificing performance.

6. Compliance and Legal Considerations:

– Regulatory Compliance: While the software includes tools for KYC/AML, operators must ensure compliance with local laws and regulations, as HYIPs are often subject to scrutiny due to their high risk nature.

– Risk Management: Providing tools to manage financial risks, the inherent risks associated with HYIPs need to be carefully managed by operators.

7. Support and Documentation:

– Support: Typically provides 24/7 support, either through direct channels or third-party services.

– Documentation: Comes with detailed documentation to help administrators and users understand how to effectively use the platform.

8. Potential Use Cases:

– Investment Groups: For groups that want to pool resources and manage high-yield investments.

– Online Fund Management: Small and medium-sized fund managers that want to automate their investment activities.

– Referral-Based Monetization Programs: Platforms rely heavily on a referral-based model for attracting users.

9. Licensing and Pricing:

– Licensing: Available via a one-time purchase or subscription model, depending on the provider.

– Pricing: Varies based on features, number of users, and level of customization required. Typically includes an upfront cost plus optional fees for additional modules or extended support.

Tiếng Việt

Tiếng Việt

Reviews

There are no reviews yet.